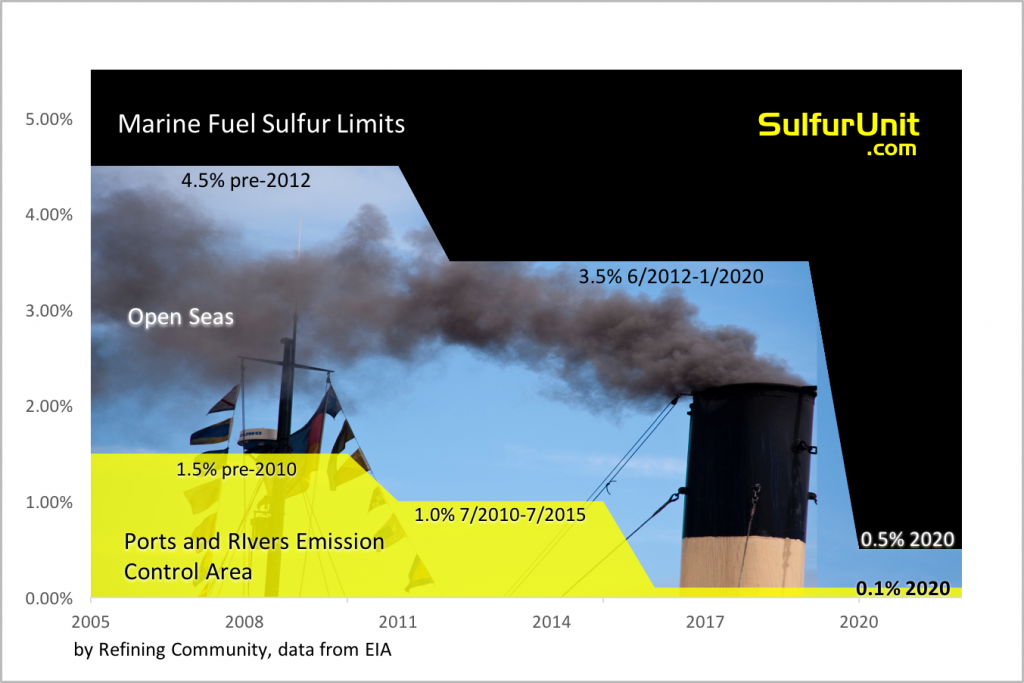

The International Maritime Organization (IMO) decided to reduce the maximum allowable levels of sulfur and other pollutants in marine fuels used on the open seas from 3.5% by weight to 0.5% by weight by 2020.

The sulfur content of transportation fuels has been declining for many years because of increasingly stringent regulations. In the United States, federal regulations like Tier 3 and state regulations limit the amount of sulfur present in motor gasoline, diesel fuel, and heating oil and how refineries make the products. Euro 5/6 regulates emissions from diesel and gasoline vehicles. These and the new international regulations limiting sulfur in fuels for ocean-going vessels have further implications for both refiners and vessel operators at a time of high uncertainty in future crude oil prices. These will be major factors in refinery operational decisions.

Bunker fuel—the fuel typically used in large ocean-going vessels—is a mixture of petroleum-based oils. Residual oil—the long-chain hydrocarbons remaining after lighter and shorter hydrocarbon fractions such as gasoline and diesel have been separated from crude oil—currently makes up the largest component of bunker fuel. The sulfur content of crude oil tends to be more concentrated in heavier hydrocarbons, with heavier petroleum products such as residual oil having higher sulfur content than lighter ones like gasoline and diesel.

Besides the IMO lowering emissions in the open seas from 3.5% to 0.5%, Emissions Control Area (ECA) requirements regulate coastal waters and specific sea-lanes in North America and Europe. A new ECA limit lowered maximum sulfur content of fuels from 1.0% to 0.5% by weight in July 2015 and further reduces to 0.1% in 2020. All these limits present several challenges for both refiners and shippers.

The first challenge for refiners is to increase the supply of lower sulfur blendstocks to the bunker fuel market. Refiners have several potential paths. One approach is to divert more low-sulfur distillates into the bunker fuel market. Another option is to use low-sulfur intermediate refinery feedstocks in bunker blends.

A second challenge for refiners is deciding what to do with the high-sulfur residual oil that can no longer be blended into bunker fuel. Adding capacity to desulfurize residual oil is one option, but the economics to do so are not currently attractive to refiners. An alternative strategy is to build or expand refinery units that take heavy hydrocarbons and upgrade them into lighter, more valuable products. In either of these cases, refineries would be faced with investments and costs that are acceptable only if there is certainty of future demand from the shipping industry.

Vessel operators have an option to install scrubbers to remove pollutants from ships’ exhaust, allowing them to continue to use higher sulfur fuels. Widespread scrubber installations could make refiners hesitant about making large investments to build refining units capable of upgrading the residual oils. Some newer ships can use liquefied natural gas (LNG), but the infrastructure to support the use of LNG fuel is currently limited in both scale and availability.

Shippers will also be faced with higher costs as the sulfur content in marine fuels decreases and as the role of distillate in the bunker fuel market increases. An example of the price difference between fuels can be observed at the Amsterdam-Rotterdam-Antwerp refining and trading hub in Northwest Europe. In 2016, prices for low-sulfur gasoil, a type of distillate, have averaged over $20 per barrel more than high-sulfur fuel oil (residual oil for use as a fuel) to date. Fuel blends used to meet the new IMO regulations are likely to be priced somewhere between these two fuels. Reference www.eia.gov/todayinenergy/detail.php?id=28952

Source: U.S. Energy Information Administration, based on Thomson Reuters Courtesy of EIA

Presentations and discussions at RefComm Galveston 2017 and RefComm® Budapest 2017 will cover low-sulfur regulations and options for dealing with them as they apply to Delayed Coking (DCU), Fluid Catalytic Cracking (FCCU) and Sulfur Recovery (SRU). #refcomm

About the author: Paul Orlowski is General Manager of Refining Community.

Refining Community has been hosting RefComm® and other conferences for Coker, CatCracker, Sulfur and I&E since 2001. Refining Community also offers training courses and consulting services for greenfield and experienced producers. Learn more at Refining Community.com, Coking.com, CatCracking.com, SulfurUnit.com and RefineryOperations.com. Contact information is on the websites.